I don’t get angry much these days, and when I do, I try to conceal it. Especially online, where anger is cheap, and fury is cheaper, and outrage is free. But if this doesn’t make you righteously enraged, I don’t know what will. https://on.wsj.com/3AOfnSL

This piece in The Wall Street Journal tells a truly terrifying story of several graduates from Columbia University, specifically, graduates from their master’s film school who incurred a level of student debt that’s almost impossible to comprehend. In exchange for this crushing, soul-deadening, mind-bogglingly unnecessary millstone of self-inflicted liability, each graduate received an education from The Ivy League. An education that will prepare them for a career in film. A career that will almost guarantee their complete and total inability to repay their loans, support a family, or work in their chosen field.

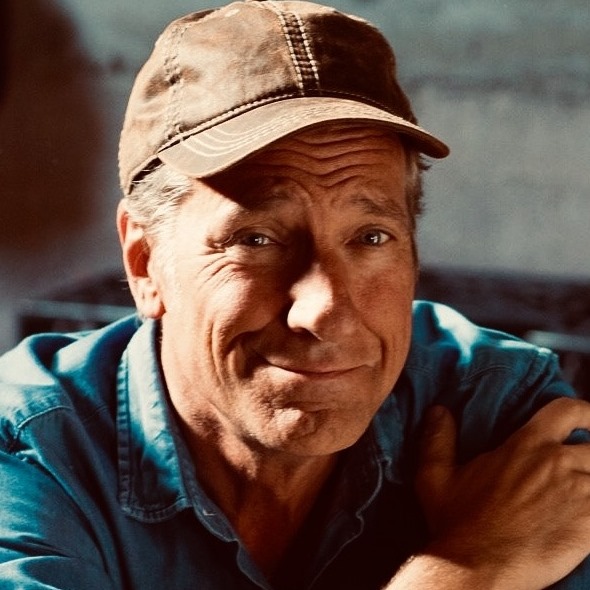

Depending on your browser, the article might be behind a paywall, so I’m cutting and pasting a few relevant paragraphs for your edification/horror. I’m also sharing a few of the photos of students that accompanied the story. I’m not doing this to shame anyone – obviously, they have already consented to share their name and likeness in the national press, and frankly, I applaud them for doing so. Because these people are living proof of what happens when we tell an entire generation that a university experience is the best path for the most people. These are the cautionary tales we all need to see.

The article starts like this…

“Recent film program graduates of Columbia University who took out federal student loans had a median debt of $181,000. Yet two years after earning their master’s degrees, half of the borrowers were making less than $30,000 a year. Recent Columbia film alumni had the highest debt compared with earnings among graduates of any major university master’s program in the U.S. The New York City university is among the world’s most prestigious schools, and its $11.3 billion endowment ranks it the nation’s eighth wealthiest private school.”

Not angry yet? Read on, because Columbia isn’t alone. Far from it…

“At New York University, graduates with a master’s degree in publishing borrowed a median $116,000 and had an annual median income of $42,000 two years after the program. At Northwestern University, half of those who earned degrees in speech-language pathology borrowed $148,000 or more, and the graduates had a median income of $60,000 two years later. Graduates of the University of Southern California’s marriage and family counseling program borrowed a median $124,000 and half earned $50,000 or less over the same period. The no-limit loans make master’s degrees a gold mine for universities. For the first time ever, graduate students are on track to have borrowed as much as undergraduates in the 2020-21 academic year.”

Is that not mind-blowing? Zach Morrison – the guy in the glasses – is typical of those profiled in the article. He’s 29 years old with an MFA from Columbia, and he’s finally come to the realization that he’s screwed. From the article…

“There’s always those 2 a.m. panic attacks where you’re thinking, ‘How the hell am I ever going to pay this off?’ His graduate school loan balance now stands at nearly $300,000, including accrued interest. He has been earning between $30,000 and $50,000 a year from work as a Hollywood assistant and such side gigs as commercial video production and photography.”

Sadly, Zach Morrison isn’t alone. Check out this nightmare scenario from 41-year old Patrick Clement. He too, got suckered by the siren song of the Ivy League. Big-time.

“As a poor kid and a high-school dropout, there was an attraction to getting an Ivy League master’s degree,” said Mr. Clement, 41. He graduated in 2020 from Columbia, borrowing more than $360,000 in federal loans for the degree. To pay the bills, he teaches film at a community college and runs an antique shop. In about a dozen Columbia master’s programs, the majority of recent graduates weren’t repaying the principal on their loans or took forbearance, according to data released for the first time this year. After 20 to 25 years on an income-dependent payment plan, the balance on Grad Plus loans—roughly $11.2 billion issued in the school year that ended in 2020—can be forgiven. Taxpayers will bear any losses.”

Read that last sentence again and tell me you’re not pissed. If you’re not, read it again. A university with an $11 billion endowment gets to charge students whatever the students are willing to borrow – knowing full-well that the majority will never earn enough in their chosen field to pay off the debt. Fine. It’s a free country. Buyer beware, etc. But when the students default, as they almost surely will, you and I will pick up the slack. Why? Is it really in America’s best interest to create more aspiring filmmakers? At over $300K per student?

Consider the case of Matt Black…

“Matt graduated from Columbia in 2015 with an MFA in film and $233,000 in federal loans. He’s 36-years old and struggling to make ends meet. He signed up for an income-based repayment plan that in leaner years requires no remittance. But with interest, his balance now stands at $331,000.”

Why in the world would anyone borrow that kind of money to study film? Steven Spielberg didn’t. Christopher Nolan didn’t. Paul Thomas Anderson, Ethan Coen, Wes Anderson, Terry Gilliam, Stanley Kubrick…never mind the Ivy League – those guys didn’t go to film school at all. Hell, Quentin Tarantino learned everything he needed to make Reservoir Dogs working in a video store and watching movies for free. Why in the world did Matt Black think he needed to mortgage his soul to Columbia University to make a movie? According to the article…

“We were told by the establishment our whole lives this was the way to jump social classes,” he said of an Ivy League education. Instead, he said he feels such goals as marriage, children and owning a home are now out of reach. During a car ride last year with three friends from the film program, Mr. Black said, they calculated they collectively owed $1.5 million in loans to the federal government. “Financially hobbled for life,” he said. “That’s the joke.”

I’m not laughing. Are you? Is anyone? I mean, aside from the hucksters and con men who are getting rich of this taxpayer-funded scam?

Check this out, toward the end of the article…

“Around two-thirds of domestic students in the MFA film program take federal loans. Grant Bromley, 28, accumulated $115,000 in federal loans while getting his Master of Arts in film and media studies at Columbia. He had hoped to advance into academia after graduating in 2018. Instead, he moved back home with his parents in Knoxville, Tenn. He now works at a TJ Maxx near Chattanooga. He is working on his third feature film in his spare time, but currently earns around $16 an hour and can’t afford to pay down his loan balance.”

Good God. Where will it end? When will it stop?

As many of you know, I’ve taken a lot of grief over the years for telling people not to “follow their passion,” but rather, to bring it with them, as they pursue opportunities in the skilled trades. That’s the message I’ve been trying to deliver to people like Grant Bromley, Zach Morrison, Pat Clement, Matt Black, and countless others who have been told to pursue their dreams and follow their passion no matter the cost. The same people who have been told that more college = more success. The same people who, according to the article, were told by administrators at Columbia to, “borrow more.”

Earlier this week, my foundation awarded a million dollars in work ethic scholarships to 138 students who chose another path. A path that will provide them with a skill that’s actually in demand. A skill that will provide them endless opportunity to advance and grow into a meaningful and balanced career. A career that will NOT begin with the crushing weight of an incomprehensible financial burden.

I could not be more proud of these 138 future tradespeople, and normally on this page, I share the many success stories of people who have applied for one of my scholarships. I will continue to do so in the future, because those stories prove that a college degree is not a prerequisite for a prosperous life. But the stories in this article – sad as they are – also need to be shared. Because we’re not just talking here about a bunch of grad students who got conned by the Ivy League. We’re talking about millions of people who hold over $1.7 trillion dollars in student loans. Many with diplomas and degrees, but none of the skills that employers today are desperate for, and no practical ability to repay their debt. And so, the taxpayers are once again being asked to pick up the tab. Even as a new generation of desperately naive kids are being encouraged to “borrow more,” by colleges and universities with billions of dollars in the bank.

Like the bumper sticker says, “If you’re not angry, you’re not paying attention.”

Mike’s Facebook Page

‘Financially Hobbled for Life’: The Elite Master’s Degrees That Don’t Pay Off